XRP Price Prediction: Technical Consolidation and Bullish Fundamentals Signal Potential Breakout

#XRP

- Technical indicators show consolidation near support with bullish MACD momentum suggesting potential upward movement

- Regulatory developments and potential ETF approval could catalyze significant institutional investment and price appreciation

- Growing utility in payments, DeFi, and institutional adoption provides fundamental strength beyond speculative trading

XRP Price Prediction

Technical Analysis: XRP Consolidates at Key Support Level

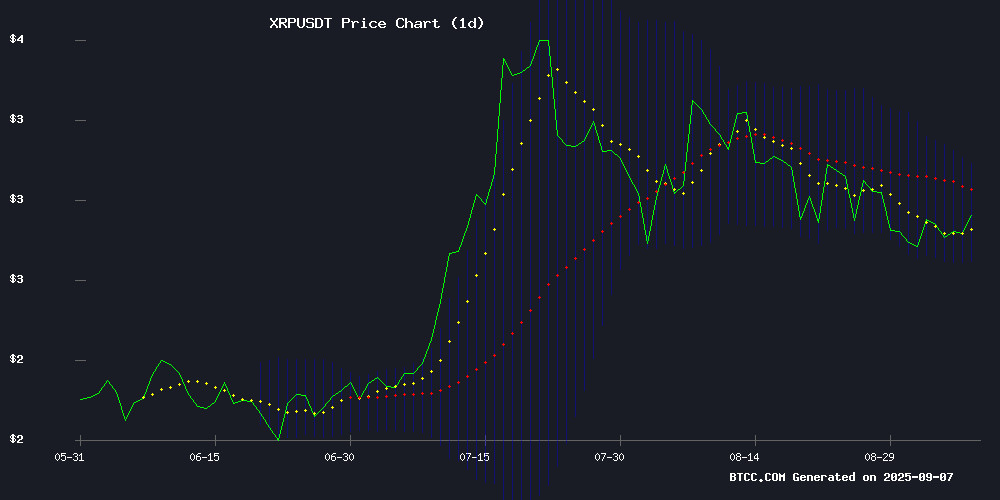

XRP is currently trading at $2.8208, slightly below its 20-day moving average of $2.8869, indicating a period of consolidation. The MACD reading of 0.1264 versus 0.1199 shows marginal bullish momentum with a positive histogram of 0.0065. According to BTCC financial analyst Robert, 'XRP is trading within the Bollinger Bands range of $2.6967 to $3.0770, with the current price positioned NEAR the middle band. This suggests the asset is in a technical equilibrium phase, potentially setting up for a decisive move.'

Market Sentiment: Institutional Interest and Regulatory Developments Drive Optimism

Positive market sentiment surrounds XRP as the Senate approaches a vote on key cryptocurrency legislation with bipartisan support. BTCC financial analyst Robert notes, 'The combination of potential ETF approval, growing institutional interest from firms like BlackRock, and expanding utility in payments and DeFi creates a fundamentally strong backdrop for XRP.' News of Ripple's SWELL 2025 conference featuring BlackRock's Digital Assets Director further reinforces the institutional narrative, while technical consolidation above $2.80 suggests underlying strength.

Factors Influencing XRP's Price

Senate Nears Vote on Key Crypto Bill Amid Bipartisan Push

The U.S. Senate is advancing its crypto market structure bill, with updated provisions clarifying the treatment of tokenized securities. The legislation, now expected to face committee votes in October, aims to resolve long-standing ambiguities around digital asset classification.

Senator Cynthia Lummis remains confident the bill will reach the president's desk this year. The revised language explicitly excludes tokenized stocks from commodity designation, a move watched closely by industry players like Coinbase and Ripple.

This legislative push represents Washington's most concerted effort yet to establish clear rules for crypto assets. Market participants anticipate the bill could catalyze institutional adoption by removing regulatory uncertainty.

XRP Price Prediction: ETF Approval Could Spark Major Rally as Institutional Interest Grows

XRP trades at $2.81 with $5.55 billion daily volume following Ripple's landmark $125 million settlement with the SEC in August. The resolution classified XRP as a non-security for public transactions, removing a key regulatory overhang that had stifled institutional participation.

Sixteen ETF applications have flooded in from heavyweight asset managers including Grayscale, Bitwise, and WisdomTree, with markets pricing in an 87% approval probability. BlackRock's involvement in Ripple's Swell 2025 conference has further fueled speculation about imminent ETF products.

Analysts project 2025 price targets between $5-10, anticipating $5-8 billion in initial ETF inflows should approval occur. The token currently holds $167.35 billion market capitalization as the fourth-largest cryptocurrency, though it dipped 1.3% in the past 24 hours.

Technical charts show XRP trading in a descending channel with critical support at $2.70. The August settlement has unlocked pent-up institutional demand, with the market now waiting to see if ETF approvals can catalyze the next leg up.

XRP Holds Above $2.82 Amid Institutional ETF Speculation and Technical Consolidation

XRP's price action remains tightly range-bound, with a sharp rejection at the $2.88-$2.89 resistance level triggering a 4% pullback before stabilizing above $2.82. Institutional selling pressure and elevated exchange balances continue to cap upside momentum, while whale accumulation of 340 million tokens suggests underlying demand.

The market now watches two critical catalysts: the $2.77 support pivot holding firm, and impending SEC decisions on six spot XRP ETF filings expected in October. Trading volumes spiked to 280 million tokens during the Sept 5 decline, confirming the $2.88-$2.89 zone as formidable resistance.

Broader macro forces loom large—Federal Reserve policy shifts and inflation data are reshaping liquidity conditions across crypto markets. The 47-day consolidation under $3.00 reflects this tension between institutional accumulation and persistent supply overhang from exchange reserves exceeding 3.5 billion XRP.

XRP Trading Surges Amid Growing Demand for DEAL Mining Contracts

XRP's upward trajectory in the global payments market has sparked renewed interest among crypto investors, with many seeking stable returns beyond speculative trading. Leading cloud mining platform DEAL Mining reports a 35% increase in registrations since August, particularly in Europe and Asia, as market participants diversify their strategies.

The global cloud mining sector is projected to reach $8.9 billion by 2027, growing at 23% annually, according to CryptoCompare data. This aligns with Statista findings showing 68% of crypto investors prefer predictable income streams over volatile trading. "I didn't want to stare at charts every day," said Lena, a Berlin-based financial analyst using DEAL Mining to generate daily returns from her XRP holdings.

DEAL Mining's $15 sign-up bonus and daily payout structure appear to resonate with risk-conscious investors. The platform's growth mirrors broader industry trends where proof-of-work alternatives gain traction during market recoveries.

BlackRock's Digital Assets Director to Speak at Ripple's SWELL 2025 Conference

Ripple has announced that Maxwell Stein, BlackRock's Director of Digital Assets, will participate in SWELL 2025, the company's flagship crypto conference. Stein is slated to discuss the transformative potential of tokenized assets in capital markets, sparking speculation about BlackRock's interest in an XRP ETF. The event, running from November 3-5, will host over 600 attendees and 60 speakers, including Moody’s Investor Services managing director Rory Callagy.

The conference agenda emphasizes digital payments, stablecoins, and blockchain adoption, with Ripple President Monica Long delivering opening remarks. Stein’s presence fuels market anticipation, given BlackRock’s prior denials of XRP ETF filings. Institutional engagement at this scale signals growing mainstream validation for crypto assets.

XRP Consolidates at Key Support Zone as Bulls Eye $3 Breakout

XRP's price action has entered a decisive phase, consolidating between $2.81 and $2.84 as traders anticipate a potential breakout. The $2.93 level emerges as immediate resistance, with a breach potentially propelling the asset toward the psychologically significant $3 threshold—a move that could catalyze renewed bullish momentum.

On-chain metrics reveal accumulating positions from large-wallet investors, signaling institutional confidence despite short-term volatility. Meanwhile, cloud mining platform GMO Miner continues attracting attention with its hardware-free model, offering participants exposure to crypto mining without capital-intensive infrastructure requirements.

XRP Eyes $2.80 as BlockchainFX (BFX) Presale Raises $6.8 Million

Ripple's XRP faces a 22% decline from its July peak, now trading at $2.80 amid a broader market recalibration. The token's technical structure shows a descending parallel channel, with critical support at $2.63 and resistance between $2.87 and $3.20. Whale accumulation patterns suggest strategic positioning ahead of potential volatility.

Meanwhile, BlockchainFX emerges as a dark horse, securing $6.8 million in its presale. The project positions itself as a contender in decentralized finance, capitalizing on growing investor appetite for early-stage opportunities. XRP's long-term thesis remains intact—analysts project a $41 price target should it capture 15% of a potential $16.4 trillion tokenized asset market by 2030.

XRP Holds Steady Near $2.80 as Rollblock Gains Traction Among Investors

XRP maintains a sideways structure around $2.81, with bulls defending the $2.80 support level. Traders eye a potential breakout above $3.10, which could propel the token toward $3.40. Some analysts project a $5 target in coming months, fueled by regulatory tailwinds and Ripple's expanding cross-border payment infrastructure.

Meanwhile, Rollblock emerges as a dark horse, attracting wallet share with its 580% token surge and revenue-sharing model. The gaming-focused protocol capitalizes on a $450 billion industry ripe for blockchain disruption, contrasting with XRP's reliance on institutional adoption.

Regulatory developments loom large. A joint SEC-CFTC statement now permits spot crypto assets on registered U.S. exchanges, reigniting speculation about potential XRP ETF filings. Ripple's recent partnership with Thunes strengthens its position across 90+ markets, though Rollblock's deflationary mechanics appeal to investors chasing exponential gains.

XRP Price Potential if Adopted by Top 10 Central Banks

XRP could see unprecedented price growth if the world's top 10 central banks allocate even a small portion of their $13 trillion reserves to the cryptocurrency. Currently trading at $2.81 with a $172.3 billion market cap, XRP's trajectory would shift dramatically with institutional adoption.

A 1% allocation ($130 billion) from central banks like the Federal Reserve or People's Bank of China could push XRP's market cap to $302 billion, valuing each token at $5.09. More aggressive scenarios suggest a 5% reserve allocation ($650 billion) would catapult the price to $13.84, while a 10% commitment could theoretically create a $1.47 trillion market cap for the digital asset.

The analysis underscores how institutional adoption could redefine cryptocurrency valuations. XRP's current position as a top-tier digital asset makes it a prime candidate for such hypothetical central bank experiments with digital reserves.

XRP's Expanding Role in Payments, DeFi, and NFTs Beyond Ripple

XRP is cementing its position as a versatile asset in the crypto ecosystem, transcending its traditional association with Ripple. The XRP Ledger now supports a broad spectrum of applications, from cross-border payments to decentralized finance and NFTs. xrpladam, CEO of xrp.cafe, emphasizes that XRP's utility extends far beyond Ripple's initiatives, pointing to real-world asset tokenization and hundreds of projects building on the ledger.

The token's proven efficiency in remittances and cross-border transactions remains a cornerstone of its value proposition. Attorney Bill Morgan recently underscored the superiority of bridge currencies like XRP, which facilitate rapid and cost-effective value transfer across borders.

Meanwhile, the stablecoin RLUSD is gaining traction, signaling potential broader institutional adoption. The XRP Ledger's growing DeFi and NFT ecosystems further highlight its expanding use cases, positioning XRP as a multifaceted player in the digital asset space.

XRP Eyes $5 Rally Despite 25% Drop from July Peak

XRP has tumbled 25% since its July high of $3.65, testing investor resolve. Yet crypto researcher Ripple Van Winkle points to on-chain data showing whales accumulating the token—a historical precursor to rebounds. Key support at $2.70 could springboard prices toward $2.90 resistance, with analysts like Ali Martinez eyeing $3.70 as the next target.

Technical charts suggest a five-wave advance may propel XRP to $4.16, $4.63, and ultimately $5.39—potentially setting new all-time highs by 2025. The token's precedent for explosive growth remains intact, having surged sevenfold from $0.49 to $3.65 in under a year.

AI models including ChatGPT and Grok echo this optimism, generating bullish price forecasts that align with trader expectations. Market participants now watch for confirmation of the uptrend as accumulation patterns mirror previous recovery cycles.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment opportunity. The asset is consolidating at a key support level of $2.80 while maintaining positive technical indicators. Fundamentally, several catalysts could drive price appreciation:

| Factor | Impact | Potential Outcome |

|---|---|---|

| ETF Approval Speculation | High | Major rally potential |

| Regulatory Clarity (Senate Vote) | High | Reduced uncertainty, institutional adoption |

| Institutional Interest (BlackRock) | Medium-High | Sustained demand growth |

| Technical Consolidation | Medium | Potential breakout above $3.00 |

BTCC financial analyst Robert emphasizes that 'the convergence of technical support, regulatory progress, and growing institutional participation creates a favorable risk-reward scenario for XRP investors.'